Electrochaea closes €36M financing round

Munich, 07 January 2022

Power-to-gas company Electrochaea announced today a € 14.9M equity investment from the European Innovation Council (EIC) Fund. This investment completes the €36 million Series D round, led by the energy technology company Baker Hughes and existing partners MVP, Storengy (an ENGIE subsidiary), btov, KfW, Energie 360°, Caliza, and Focus First. The purpose of this investment round is to accelerate the scale up and commercialization of Electrochaea’s technology that produces a replacement for fossil natural gas while storing renewable energy and reusing CO2.

The equity funds permit Electrochaea to catalyze the construction of a commercial European project, through direct investment of funds, and to realize the engineering work completed under the €2.5 million award that Electrochaea received in August 2020 from the “EIC Accelerator” program, a part of the EU research and innovation program “Horizon 2020”. The EIC equity investments are made to scale-up game-changing innovative technologies that promote Europe’s goal to reach net-zero greenhouse gas emissions by 2050.

Electrochaea’s power-to-gas biomethanation technology produces grid-quality renewable methane using CO2 and renewable hydrogen. Renewable methane can replace any use of fossil natural gas, thereby significantly reducing greenhouse gas (GHG) emissions, utilizing investment in existing gas distribution and storage infrastructure, and contributing to the transition to a clean energy economy.

“Equity support from the EIC Fund will have a significant impact on Electrochaea’s ability to deliver renewable gas to customers throughout Europe and the world,” said Mich Hein, CEO of Electrochaea. “Technologies that can deliver on net-zero greenhouse emission goals need to be scaled up and brought to the market without delay. Electrochaea´s biomethanation technology, which has been proven in two demonstration plants, one in Denmark and one in Switzerland, is an ideal solution to replace fossil gas with fully renewable gas and to participate in the energy transition.”

“Electrochaea is a great example of how the EIC Fund is supporting the climate tech innovators to bring their technologies to the market and help achieving the Green deal objectives,” added Martin Bruncko, member of the EIC Fund Investment Committee. “This equity financing will support Electrochaea to successfully produce at industrial scale renewable methane that replaces natural gas and can be stored and transported in the existing gas grid.”

About Electrochaea | www.electrochaea.com

Electrochaea delivers a technology to produce renewable methane, a fuel that replaces natural gas, and can be stored and transported in the existing gas grid. Electrochaea’s patented process combats climate change by utilizing CO2, producing a renewable fuel, and providing a solution for long-term storage of intermittent renewable energy. The company is planning to deploy its technology with partners to produce more than 15 billion cubic feet per year of renewable bio-synthetic natural gas by 2025. Industrial-scale pilot plants have operated in the U.S., Switzerland, and Denmark. Electrochaea is headquartered in Munich, Germany, with subsidiaries in Denmark and the U.S.

Kebony raises €30M in funding

- Kebony’s patented wood modification technology enhances the qualities of sustainable softwood, giving it the characteristics and usability of premium hardwood

- Kebony enables the production of sustainable and environmentally friendly wood at low cost, which has the potential to transform the construction industry

- Kebony has demonstrated strong year-on-year growth, and will use the funding to expand and scale across the European and US markets

Oslo, 27 October 2021

Kebony, the leading environmentally friendly wood modification technology company, today announces a successful EUR 30 million funding round led by Jolt Capital and Lightrock. Kebony’s vision is to reduce CO2 emissions and tropical deforestation using its patented wood modification techniques, which produce superior wood in an environmentally friendly way.

The key disruptive trends in the construction industry are expressed by the need for greener, safer and better products, as the standard construction materials concrete and steel are large emitters of CO2 globally. In addition, the current large market for tropical wood is set to be replaced by enhanced wood to protect bio-diversity and reduce tropical deforestation.

The Kebony® technology permanently transforms sustainable wood species such as pine into Kebony wood with features that are comparable, and in some cases superior, to those of precious tropical hardwoods. This unique environmentally friendly process is also a superior alternative to traditional wood treatment based on impregnation with wood preservatives.

Kebony’s EUR 30 million financing round is led by Jolt Capital and Lightrock, who will join longstanding Kebony shareholders such as Goran, MVP, FPIM, PMV and Investinor, of which the latter two will remain represented on the Board of Directors. The capital injection will expand and accelerate Kebony’s growth initiatives in core markets in Europe and the US. The funding will enable Kebony to further penetrate a EUR 3 billion market, and leverage the underlying megatrends of producing sustainable materials for the residential and non-residential construction industries.

“Kebony produces the most beautiful and ecological wood on the market, with a superior quality that is both environmentally friendly and cost-effective. To further leverage opportunities within the enhanced wood technology industry, we are proud to announce Jolt Capital and Lightrock as new investors in Kebony,“ says Norman Willemsen, Chief Executive Officer of Kebony.

“At Jolt Capital we have a strong interest in material science companies which leverage their patented technologies to offer sustainable products. With over 20 years of R&D in woodtech and a well-proven process that gives cultivated soft woods the desirable properties of hard tropical ones, Kebony is one of them. We are thrilled to finance the expansion of their European production facilities to both support the strong market growth and offer an alternative to rainforests deforestation,” says Antoine Trannoy, Managing Partner at Jolt Capital.

“Kebony is perfectly positioned in the race for a decarbonized world with an ambition to be the leader within wood modification technologies. We look forward to supporting the company to implement its growth strategy and to leverage the significant operational scalability and continue the profitable growth journey,” says Kevin Bone, Partner at Lightrock.

“The new management team has conducted a successful transformation of the company, and with backing of our new high-quality investors providing improved financial flexibility, Kebony can accelerate growth, enhance its technology development roadmap, and explore potential acquisitions. The addition of Didier Roux and Rebekah Braswell to the Board of Directors will strengthen Kebony’s expansion and scalability. Coupled with the company’s unique selling proposition and backed by double-digit growth, we believe Kebony is ideally positioned to unlock the full potential of sustainable and enhanced wood.” says Cornelius Walter, newly appointed Chairman of the Board of Directors.

“Kebony reported a revenue growth of 23% in the first half of 2021, compared to the same period in 2020, with a strong positive EBITDA. The revenues in 2020 had already increased by 26% year-over- year, with a significant EBITDA improvement, driven by the company’s geographical growth strategy in key markets. The finalization of the private placement significantly strengthens Kebony’s financial flexibility and supports the accelerated growth strategy,” says Thomas Vanholme, Chief Financial Officer of Kebony.

“As early investors in Kebony, we were impressed by the technology and the market opportunity that lay in substituting tropical hardwood with a sustainable alternative. We have seen the company through its transition from an early pioneer in the modified wood market to being a market leader in the segment, with demonstrated international growth potential. We are delighted to have Lightrock and Jolt Capital bring momentum to scaling Kebony in the years to come. What better way to make a massive impact on sustainability than stopping logging of precious tropical hardwoods, whilst still providing a long-lasting wood alternative to concrete, plastic and steel?” added Thomas Hoegh, Founder and CEO of Arts Alliance Ventures.

Carnegie AS and Pareto Securities AS have acted as financial advisors to the company.

About Kebony | www.kebony.com

Kebony is a Norwegian company which aims to be the leading wood brand and technology company. Underpinned by proven wood modification technologies, it produces an enhanced wood of a superior quality that is both environmentally friendly and cost-effective.

The company’s headquarters is based in Oslo, while production, research and development and other administrative functions are located in the Skien municipality, south of Oslo. In addition, the Group has a production facility in Antwerp, Belgium. Kebony has subsidiaries in Norway, Denmark and Sweden, sales representatives in Germany, France, UK and the US and a wide distribution network internationally. Shareholders are leading the venture with private equity investors from Belgium, Germany, France, Norway and UK. The company has received numerous awards for its environmentally friendly technology and innovation, including its naming as a World Economic Forum Technology Pioneer.

The Kebony® technology permanently transforms sustainable wood species such as pine into Kebony wood with features that are comparable, and in some cases superior, to those of precious tropical hardwoods. This unique environmentally friendly process is also a superior alternative to traditional wood treatment based on impregnation with biocides (wood preservatives). The company’s patent- protected production processes yield products that deliver major improvements in durability and dimensional stability, at the same time as being highly attractive. The Kebony products are suitable for a multitude of applications and designs – encompassing both indoor and outdoor applications.

Kebony’s purpose and mission is through active innovation, quality thinking and understanding of commercial possibilities; give the world beautiful, long lasting and environmentally friendly wood products. The company will show social responsibility and contribute to improvements of the environment in a way that builds a better future.

sonnen: Transforming the energy sector along the Triple Top Line

sonnen is one of the world’s leading manufacturers of battery systems for the storage of photovoltaic electricity for private households. Back in 2014, MVP was among the first investors of the company based in Wildpoldsried, Germany. In 2019, sonnen was acquired by Shell, which together with sonnen aims to become the world’s leading energy service provider by 2030. For the cleantech sector in Europe, the takeover was one of the most successful venture capital exits ever.

Key factors for sonnen’s success were the ongoing willingness to transform its product, business model, and team, as well as a business strategy based on the Triple Top Line concept. This ultimately led to significant changes in the energy market. And it makes sonnen a Transformative Technology in the best sense of the word and a perfect example to illustrate our investment strategy.

Transformation of product and business model

The first sonnenBatteries offered customers the opportunity to store self-produced PV electricity and to use it in times without sufficient sunlight. The company’s growth in the early years was proof that the sonnenBatterie was one of the best products on the market (Improvement of the Value Chain).

From the very beginning, however, the sonnen team understood the sonnenBatterie as the platform on which further products and services could be offered. The possibility of connecting all sonnenBatteries via the Internet of Things (IoT) enabled sonnenBatterie customers to share self-produced and stored electricity, which was the starting point for the sonnenCommunity. By that, today’s centrally structured value chain from electricity production in large power plants to the consumption at the end customer is eliminated by decentralized production and storage (Enhancement of the Value Chain).

With the next expansion stage of the sonnen business model, sonnenNow, customers will be offered a complete package consisting of a photovoltaic system, a sonnenBatterie and clean electricity, without any investment costs for the customer. This means that sonnen offers a Power-as-a-Service solution instead of a hardware product. A revolutionary step, which is only known from the software sector so far, or in the first tentative steps in the mobility sector. sonnen thus transforms the entire value chain of power supply (Reconstruction of the Value Chain) and becomes the energy utility of the future.

Transformation of the team

sonnen has continuously strengthened its team and adapted it to the requirements of the company’s development from its foundation to the present day. In the first years the focus was on product development and sales. In the following years, the supply chain and production team also had to be expanded. With the introduction of the sonnen Community, the interconnection of sonnenBatteries, the establishment of an own software team was necessary. And for the last step, the establishment of sonnen as the energy utility of the future, a team of experts with many years of experience in the energy markets was set up. With the growth from the small founding team around Christoph Ostermann and Torsten Stiefenhofer to a medium-sized company with several hundred employees, the organization, including finance, HR, marketing, had to be continuously expanded.

To successfully manage this substantial transformation of the team organization in just a few years is one of the essential success factors for the rapid scaling of start-ups – sonnen has mastered this excellently.

Focus on Triple Top Line growth

sonnen’s slogan “clean and affordable energy for everybody” illustratively reflects that the company follows a business strategy, which considers not only economic growth but also social equity and sustainable environmentally friendly product development. From the very beginning, sonnen’s primary goal has been to make more renewable energy available to private customers, and thus make a contribution to an ecologically sustainable energy supply (Ecology). The new approach of making the sonnen solution accessible to customers without investment costs ensures social Equity. Combining these two aspects with a highly scalable business model, sonnen was also able to achieve extraordinary economic growth (Economy).

With this consistent pursuit of the Triple Top Line concept, sonnen shows that growth and economic success do not require compromises with regard to environmental benefit and social equity, but that all three aspects reinforce each other positively. It was decisive for the outstanding development of sonnen and ultimately for the takeover by Shell. (Read more about our Triple Top Line investment strategy)

What's "driving the eco-industrial revolution" about?

Climate change has entered a new phase. Alarming signals of an ever more rapid change in the biosphere are increasing. And scientists highlight that earth may have already passed several climate change tipping points which has irreversible effects, such as the loss of the Amazon rainforest and the great ice sheets of Antarctica and Greenland. At the same time, it is becoming a decisive political factor with hundreds of thousands of young people pioneering a new extra-parliamentary climate opposition.

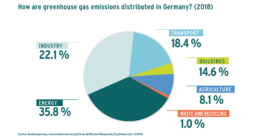

…it’s about decoupling economic growth from environmental pollution

As the world’s population is rising to over 9 billion people in 2050, countries of the South and the East are becoming increasingly industrialized, and cities continue to grow, global economic output will roughly double in the next 30 years. Over the same period, greenhouse gas (GHG) emissions will have to fall dramatically in order to reach the GHG reduction targets set by governments. For the EU, the binding target is a cut by at least 40% compared to 1990 levels by 2030. This puts a great burden on the economy. However, the question is not whether the global economy will continue to grow. The key question is whether we can decouple value creation from environmental pollution.

The recipe is nothing less than a new industrial revolution with an impact similar to the invention of the steam engine, industrial steal making, or the automobile: the eco-industrial revolution.

In essence, it is about a threefold transformation of the old industrial society: firstly, a complete shift from fossil energy sources to renewable energies; secondly, a continuous increase in resource efficiency to generate more value from fewer raw materials and energy; and thirdly, the transition to a circular economy in which the productivity of resources is increased.

…it’s about fostering the transformative power of technology

Similar as the first industrial revolution was triggered by the invention of the stream engine, also the eco-industrial revolution will be driven by technological innovations and their expansion. However, this time, we require technologies that allow a rethinking of existing value chains to reduce CO2 emissions along the entire process of value creation.

At MVP, we call such technologies that (I) improve, (II) enhance, or (III) reconstruct existing value chains Transformative Technologies. They trigger fundamental changes and paradigm shifts in existing business areas in short time frames. To some degree, Transformative Technologies can also be viewed as disruptive. However, rather than the disruptive “destroy and build new” approach, Transformative Technologies may also enable developing new enhanced solutions using existing infrastructure whenever possible. They are the basis for shaping the future and have an extraordinary growth potential. Identifying these opportunities and financing appropriate technologies and solutions is one of the strategic cornerstones of MVP’s Venture Capital investment approach.

…it’s about leveraging total value potential

Our focus is on driving change in the most CO2 intensive sectors and financing businesses that can have a huge impact in achieving decarbonization of the incumbent industry. To make it clear: it’s not about limiting economic growth in favor of ecological sustainability. We are firmly convinced that economic growth and ecological sustainability are not tradeoffs, but in contrast mutually reinforcing factors. With investments in companies like sonnen we were able to verify this thesis in the past. Even more, companies and business models, which do not take into account ecological responsibility, will not be successful anymore or disappear completely.

Therefore, we integrate the concept of Triple Top Line value creation in our investment strategy to leverage the full transformative potential of a technology. Rather than balancing economical, ecological and societal targets, this approach focuses on employing their dynamic interplay to generate value. (Read more about our Triple Top Line strategy here)

Driving the industrial revolution is the core philosophy of our investment approach. In fact, that’s what we’ve been doing at MVP for over 15 years now. With this experience and the capital entrusted to us, we back pioneering entrepreneurs and become sparring partners for ambitious teams to create the business leaders of tomorrow.