Electrochaea closes €36M financing round

Munich, 07 January 2022

Power-to-gas company Electrochaea announced today a € 14.9M equity investment from the European Innovation Council (EIC) Fund. This investment completes the €36 million Series D round, led by the energy technology company Baker Hughes and existing partners MVP, Storengy (an ENGIE subsidiary), btov, KfW, Energie 360°, Caliza, and Focus First. The purpose of this investment round is to accelerate the scale up and commercialization of Electrochaea’s technology that produces a replacement for fossil natural gas while storing renewable energy and reusing CO2.

The equity funds permit Electrochaea to catalyze the construction of a commercial European project, through direct investment of funds, and to realize the engineering work completed under the €2.5 million award that Electrochaea received in August 2020 from the “EIC Accelerator” program, a part of the EU research and innovation program “Horizon 2020”. The EIC equity investments are made to scale-up game-changing innovative technologies that promote Europe’s goal to reach net-zero greenhouse gas emissions by 2050.

Electrochaea’s power-to-gas biomethanation technology produces grid-quality renewable methane using CO2 and renewable hydrogen. Renewable methane can replace any use of fossil natural gas, thereby significantly reducing greenhouse gas (GHG) emissions, utilizing investment in existing gas distribution and storage infrastructure, and contributing to the transition to a clean energy economy.

“Equity support from the EIC Fund will have a significant impact on Electrochaea’s ability to deliver renewable gas to customers throughout Europe and the world,” said Mich Hein, CEO of Electrochaea. “Technologies that can deliver on net-zero greenhouse emission goals need to be scaled up and brought to the market without delay. Electrochaea´s biomethanation technology, which has been proven in two demonstration plants, one in Denmark and one in Switzerland, is an ideal solution to replace fossil gas with fully renewable gas and to participate in the energy transition.”

“Electrochaea is a great example of how the EIC Fund is supporting the climate tech innovators to bring their technologies to the market and help achieving the Green deal objectives,” added Martin Bruncko, member of the EIC Fund Investment Committee. “This equity financing will support Electrochaea to successfully produce at industrial scale renewable methane that replaces natural gas and can be stored and transported in the existing gas grid.”

About Electrochaea | www.electrochaea.com

Electrochaea delivers a technology to produce renewable methane, a fuel that replaces natural gas, and can be stored and transported in the existing gas grid. Electrochaea’s patented process combats climate change by utilizing CO2, producing a renewable fuel, and providing a solution for long-term storage of intermittent renewable energy. The company is planning to deploy its technology with partners to produce more than 15 billion cubic feet per year of renewable bio-synthetic natural gas by 2025. Industrial-scale pilot plants have operated in the U.S., Switzerland, and Denmark. Electrochaea is headquartered in Munich, Germany, with subsidiaries in Denmark and the U.S.

What's "driving the eco-industrial revolution" about?

Climate change has entered a new phase. Alarming signals of an ever more rapid change in the biosphere are increasing. And scientists highlight that earth may have already passed several climate change tipping points which has irreversible effects, such as the loss of the Amazon rainforest and the great ice sheets of Antarctica and Greenland. At the same time, it is becoming a decisive political factor with hundreds of thousands of young people pioneering a new extra-parliamentary climate opposition.

…it’s about decoupling economic growth from environmental pollution

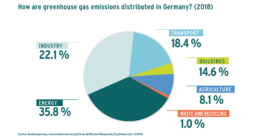

As the world’s population is rising to over 9 billion people in 2050, countries of the South and the East are becoming increasingly industrialized, and cities continue to grow, global economic output will roughly double in the next 30 years. Over the same period, greenhouse gas (GHG) emissions will have to fall dramatically in order to reach the GHG reduction targets set by governments. For the EU, the binding target is a cut by at least 40% compared to 1990 levels by 2030. This puts a great burden on the economy. However, the question is not whether the global economy will continue to grow. The key question is whether we can decouple value creation from environmental pollution.

The recipe is nothing less than a new industrial revolution with an impact similar to the invention of the steam engine, industrial steal making, or the automobile: the eco-industrial revolution.

In essence, it is about a threefold transformation of the old industrial society: firstly, a complete shift from fossil energy sources to renewable energies; secondly, a continuous increase in resource efficiency to generate more value from fewer raw materials and energy; and thirdly, the transition to a circular economy in which the productivity of resources is increased.

…it’s about fostering the transformative power of technology

Similar as the first industrial revolution was triggered by the invention of the stream engine, also the eco-industrial revolution will be driven by technological innovations and their expansion. However, this time, we require technologies that allow a rethinking of existing value chains to reduce CO2 emissions along the entire process of value creation.

At MVP, we call such technologies that (I) improve, (II) enhance, or (III) reconstruct existing value chains Transformative Technologies. They trigger fundamental changes and paradigm shifts in existing business areas in short time frames. To some degree, Transformative Technologies can also be viewed as disruptive. However, rather than the disruptive “destroy and build new” approach, Transformative Technologies may also enable developing new enhanced solutions using existing infrastructure whenever possible. They are the basis for shaping the future and have an extraordinary growth potential. Identifying these opportunities and financing appropriate technologies and solutions is one of the strategic cornerstones of MVP’s Venture Capital investment approach.

…it’s about leveraging total value potential

Our focus is on driving change in the most CO2 intensive sectors and financing businesses that can have a huge impact in achieving decarbonization of the incumbent industry. To make it clear: it’s not about limiting economic growth in favor of ecological sustainability. We are firmly convinced that economic growth and ecological sustainability are not tradeoffs, but in contrast mutually reinforcing factors. With investments in companies like sonnen we were able to verify this thesis in the past. Even more, companies and business models, which do not take into account ecological responsibility, will not be successful anymore or disappear completely.

Therefore, we integrate the concept of Triple Top Line value creation in our investment strategy to leverage the full transformative potential of a technology. Rather than balancing economical, ecological and societal targets, this approach focuses on employing their dynamic interplay to generate value. (Read more about our Triple Top Line strategy here)

Driving the industrial revolution is the core philosophy of our investment approach. In fact, that’s what we’ve been doing at MVP for over 15 years now. With this experience and the capital entrusted to us, we back pioneering entrepreneurs and become sparring partners for ambitious teams to create the business leaders of tomorrow.