Diving into the Digitalization of Maritime Logistics

The COVID-19 pandemic has undoubtedly posed significant challenges for supply chains globally. Multiple national lockdowns disrupted the transportation and logistics sector by slowing down or even stopping the flow of materials, finished goods, and people. Such changed market dynamics have also impacted companies in our portfolio which rapidly needed to adapt to new circumstances. The pandemic has indeed shed light on previously unseen vulnerabilities and even magnified problems that already existed in the transportation sector, especially in maritime logistics. While on a more positive note it offers an opportunity to re-evaluate the value chains to make them more resilient and sustainable, which makes it interesting (to MVP) for further exploration.

In 2020, almost 30% of companies reported major or severe delays in sea transport due to the COVID-19 pandemic disruption.

Due to ongoing severe disruption from the COVID-19 pandemic, the global supply chains have been reassessed and more focus has been put on local production and transport, which offered less disruption in times of crisis. This indeed brought a paradigm shift in maritime logistics which has by 2019 reached a total value of more than $14 trillion and has now focused on prioritizing resilience over efficiency. Moreover, higher risk management and resilience-building based on digitalization technologies have been put at the center of attention, especially with currently rocketing rates of freight containers due to ongoing disruption in global supply chains. Although digitalization and new developments in the field of AI, blockchain, IoT, SaaS, and automation have already emerged in the past decade as one of the main drivers of change in the maritime sector, the pandemic allowed smart technologies to be widely adopted and demonstrate their cost-effectiveness. To illustrate, in order to achieve greater efficiency of their operations almost 40% of maritime organizations have made data management a strategic priority. More, as a third of maritime organizations are seeing annual data growth of over 50%, data centralization, reduction of manual processes, and improved data quality have been ranked as top priorities for improving data management. Consequently, the pandemic underlined how important data and emergency-response technologies are for managing the transparency and predictability of supply chains. It became clear that the first movers are better able to navigate in times of high market disruption.

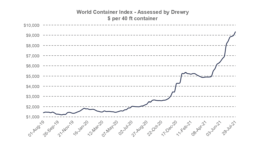

Due to ongoing disruption in supply chains, the level of the Drewry World Container Index is 368% higher than at the same time last year.

Many incumbents have already recognized the potential of the data analytics market holding a value prospection of $1,833.5M by 2027 and have set digitalization as one of the key strategies in order to safeguard the position of the market leaders. Maersk – one of the biggest shipping companies has been contracting and partnering with innovators to utilize vessel tracking and monitoring services and other applications for big data analytics. Moreover, corporations such as Siemens have started to offer digitalized shipping solutions that provide vessel operators and crew members with assistance in the decision-making process.

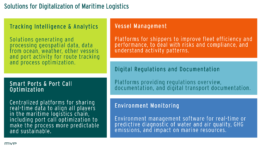

The main identified fields of application of data-based solutions are route & process optimization, smart port & port call synchronization, vessel optimization & fleet management, digital documentation, and environment monitoring which are more in detail presented in the following graphics.

On the other hand, the start-ups market has also experienced significant growth of innovators, accompanied by dynamic investment and M&A activities. For instance, Spire Global, a space-to-cloud data analytics company, raised a total of $222.7M in funding, with European Investment Bank and Mitsui Global Investment being the most recent investors. It is a successful example of a company that is leveraging Satellite AIS services to provide weather, global shipping, and vessel tracking data. More, digital solutions can also play an important role in ports which are the main hub of maritime logistics, where cargo and different means of transportation are digitally connected and managed. Therefore, Port Call Optimization solutions such as Awake.AI can assist in improved decision-making and help the port operations to become more efficient, safe, and sustainable. Another example of a digital solution that sparks interest is a Digital Twin concept like software from We4Sea which uses real-world vessel data to create simulations that predict and improve vessel performance and fuel usage.

To provide a broader insight into the digitalization of the maritime sector, we are sharing with you a map of start-ups with the potential to pave the way toward more data-driven maritime logistics.

Maritime Logistics Digitalization Landscape

Ladar Ltd, GSTS, FleetMon, Cloudeo, MaritimeAI, HawkEye 360, FAME, Aquaplot, Orca-AI, Flexport, Portcast, GeoSpock, exactEarth, Spire, Autonomous Marine Systems, ioCurrents, OceanManager, we4sea, Winward, Kaiko Systems, Nautix, Digital Twin Marine, Smart Ship, DeepSea, Intelligent Cargo Systems, PortXchange, eYARD, Portbase, awake.ai, Nauticspot, Constant Bearing, Teqplay, Flowfox, SEAPort Solutions, Edray, Regs4ships, OneOcean, essDOCS, Sinay, METIS Cyberspace Technology, Green Sea Guard, Envirosuite, BiOceanOr, and 4EI.

As more than 90% of goods are at some point transported by ships, there is no doubt that the environmental footprint of maritime logistics also requires our attention. It is essential that the increased digitalization efforts not only contribute to the greater efficiency and robustness of the shipping sector but also provide solutions for managing sustainability issues such as ocean pollution, increasing GHG emissions, biodiversity loss, and resources depletion. Besides alternative fuels and sustainable energy storage, digital solutions will be key to meet the International Maritime Organization’s (IMO) commitment to reduce the total annual GHG emissions from international shipping by at least 50% by 2050, compared to 2008.

Maritime transport is responsible for about 2.5% of global GHG emissions; however, a lack of mitigation action can lead to a significant increase.

An interesting example of such a company that is successfully combining digitalization with sustainability is a French start-up Sinay, which provides a vertical SaaS for managing data related to operations and environmental impacts for the maritime sector. It sets an example of how efficient operations can go hand-in-hand with the GHG emissions reduction potential and increased sustainable use of maritime resources. As a such, it is aligned with our focus on partnering up with start-ups that have the potential to transform value chains as well as drive change towards decarbonization and climate protection. Which other start-ups do you know that fulfill these requirements?

Let us know what you think about the future of the digitalization of maritime logistics and how it can help to achieve greater sustainability impact in the sector.

The start-ups driving Circular Fashion in Europe

Paris-based sustainable fashion company Vestiaire Collective just announced to have reached unicorn status in its new €178 million round, making it the latest European start-up to join the exclusive club. The second-hand fashion marketplace has experienced rapid growth over the last three years and has already made its way into the United States and Asia Pacific markets. The growth was certainly accelerated to some degree by the pandemic which favored digital solutions. But more importantly, Vesitaire Collective was early to capture on the material and deep-rooted shift in consumer interest towards sustainability. And this is not limited to buying and selling pre-owned clothing: especially younger consumers are increasingly aware of the environmental and social impacts of the fashion industry, demanding among others more sustainable and longer lasting products and better end-of-life solutions.

Indeed, we can’t neglect that the fashion industry has a broader sustainability issue: already before the pandemic, the equivalent of one garbage truck of textiles was landfilled or burned globally every second. This has likely increased further over the past months as shops are closed and unsold clothing piles up in fashion and textile warehouses. Furthermore, less than 1% of products are recycled into new garments and despite efforts by some players 12% of fiber is lost in production (Source). Not to forget that in some production facilities, garment workers toil 16 hours per day earning a fifth of the minimum wage required for a decent life.

10% of global carbon emissions are calculated to stem from fashion today. This could increase to up to 25% in 2050.

On a positive note, there are already several companies who strive to move the fashion industry away from the take-make-waste thinking towards circular strategies which respect all three pillars of the Triple Top Line: economic growth, environmental impact, and social equality. (Read more about the Triple Top Line idea here). Accenture estimates that circularity holds an economic value potential of $30-90 billion for the fashion industry. Indeed, it could become the biggest disruptor to the industry over the next decade.

At MVP, our focus is on partnering up with start-ups that have the potential to transform value chains and drive change in the most CO2 intensive and pollutive industries. And we see that alongside Vesitaire Collective, an entire ecosystem of start-ups has emerged in Europe that have this potential. They are developing bio-degradable raw materials, bringing transparency to the supply chain, enhancing the lifetime of clothes with rental or second-hand platforms, or recapturing raw materials from non-reusable products.

To provide an insight on our view of the industry, we want to share this (non-exhaustive) map of European Circular Fashion start-ups. It includes companies in very early development stages as well as more established players that have already raised significant amounts of funding. We want it to be a source of inspiration, collaboration, and a starting point for discussions.

Let us know what you think about the landscape and who is missing.

Circular Fashion Landscape

SupplyCompass, Upmade, Material Exchange, circular.fashion, MycoTEX, Spintex, Pili, ananas anam, Spinnova, Amadou Leather, Jeanologia, Fairly Made, rodinia, Colorifix, We aRe SpinDye, Lukso, retraced, TrusTrace, Tailorlux, Compare Ethics, Sircula, Reflaunt, Stuffstr, DressYouCan, Fjong, Hackyourcloset, By Rotation, gibbon, Hurr, Videdressing, vinted, momox, Swapush, Popswap, Sellpy, Mädchenflohmarkt, Rebelle, nuw, Vestiare Collective, Repamera, Thrift+, Zadaa, Kleiderly, REKKI, armadioverde, cudoni, Worn Again, Renewcell, Infinited Fiber, Eoe Regrind, and Sea2see.

________________________________________

Julian is Investment Associate at Munich Venture Partners. While he is not a fashion specialist nor known for an outstanding dressing style, he has great interest in the field of Circular Economy and sustainable consumption in general. With this lens, he looks at different industries and sectors. Feel free to contact him via LinkedIn.