MVP Sustainability Report 2022

In addition to generating superior financial returns for our investors, MVP’s investment strategy also focuses on investments generating positive environmental and societal impact. We therefore put great effort in our portfolio companies not only leaving the lowest environmental footprint possible as well as applying the highest social standards, but enhancing nature and society as a whole.To illustrate the ESG and impact development of our investees as well as our own sustainability efforts, MVP publishes a yearly sustainability report. Next to these topics, this year’s report also covers:

> Our approach towards sustainability

> The ESG performance of our investees as well as their contribution to the SDGs

> The MVP ESG champion

> Triple Top Line highlights from our portfolio

Diving into the Digitalization of Maritime Logistics

The COVID-19 pandemic has undoubtedly posed significant challenges for supply chains globally. Multiple national lockdowns disrupted the transportation and logistics sector by slowing down or even stopping the flow of materials, finished goods, and people. Such changed market dynamics have also impacted companies in our portfolio which rapidly needed to adapt to new circumstances. The pandemic has indeed shed light on previously unseen vulnerabilities and even magnified problems that already existed in the transportation sector, especially in maritime logistics. While on a more positive note it offers an opportunity to re-evaluate the value chains to make them more resilient and sustainable, which makes it interesting (to MVP) for further exploration.

In 2020, almost 30% of companies reported major or severe delays in sea transport due to the COVID-19 pandemic disruption.

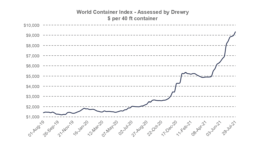

Due to ongoing severe disruption from the COVID-19 pandemic, the global supply chains have been reassessed and more focus has been put on local production and transport, which offered less disruption in times of crisis. This indeed brought a paradigm shift in maritime logistics which has by 2019 reached a total value of more than $14 trillion and has now focused on prioritizing resilience over efficiency. Moreover, higher risk management and resilience-building based on digitalization technologies have been put at the center of attention, especially with currently rocketing rates of freight containers due to ongoing disruption in global supply chains. Although digitalization and new developments in the field of AI, blockchain, IoT, SaaS, and automation have already emerged in the past decade as one of the main drivers of change in the maritime sector, the pandemic allowed smart technologies to be widely adopted and demonstrate their cost-effectiveness. To illustrate, in order to achieve greater efficiency of their operations almost 40% of maritime organizations have made data management a strategic priority. More, as a third of maritime organizations are seeing annual data growth of over 50%, data centralization, reduction of manual processes, and improved data quality have been ranked as top priorities for improving data management. Consequently, the pandemic underlined how important data and emergency-response technologies are for managing the transparency and predictability of supply chains. It became clear that the first movers are better able to navigate in times of high market disruption.

Due to ongoing disruption in supply chains, the level of the Drewry World Container Index is 368% higher than at the same time last year.

Many incumbents have already recognized the potential of the data analytics market holding a value prospection of $1,833.5M by 2027 and have set digitalization as one of the key strategies in order to safeguard the position of the market leaders. Maersk – one of the biggest shipping companies has been contracting and partnering with innovators to utilize vessel tracking and monitoring services and other applications for big data analytics. Moreover, corporations such as Siemens have started to offer digitalized shipping solutions that provide vessel operators and crew members with assistance in the decision-making process.

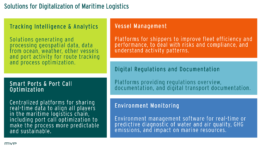

The main identified fields of application of data-based solutions are route & process optimization, smart port & port call synchronization, vessel optimization & fleet management, digital documentation, and environment monitoring which are more in detail presented in the following graphics.

On the other hand, the start-ups market has also experienced significant growth of innovators, accompanied by dynamic investment and M&A activities. For instance, Spire Global, a space-to-cloud data analytics company, raised a total of $222.7M in funding, with European Investment Bank and Mitsui Global Investment being the most recent investors. It is a successful example of a company that is leveraging Satellite AIS services to provide weather, global shipping, and vessel tracking data. More, digital solutions can also play an important role in ports which are the main hub of maritime logistics, where cargo and different means of transportation are digitally connected and managed. Therefore, Port Call Optimization solutions such as Awake.AI can assist in improved decision-making and help the port operations to become more efficient, safe, and sustainable. Another example of a digital solution that sparks interest is a Digital Twin concept like software from We4Sea which uses real-world vessel data to create simulations that predict and improve vessel performance and fuel usage.

To provide a broader insight into the digitalization of the maritime sector, we are sharing with you a map of start-ups with the potential to pave the way toward more data-driven maritime logistics.

Maritime Logistics Digitalization Landscape

Ladar Ltd, GSTS, FleetMon, Cloudeo, MaritimeAI, HawkEye 360, FAME, Aquaplot, Orca-AI, Flexport, Portcast, GeoSpock, exactEarth, Spire, Autonomous Marine Systems, ioCurrents, OceanManager, we4sea, Winward, Kaiko Systems, Nautix, Digital Twin Marine, Smart Ship, DeepSea, Intelligent Cargo Systems, PortXchange, eYARD, Portbase, awake.ai, Nauticspot, Constant Bearing, Teqplay, Flowfox, SEAPort Solutions, Edray, Regs4ships, OneOcean, essDOCS, Sinay, METIS Cyberspace Technology, Green Sea Guard, Envirosuite, BiOceanOr, and 4EI.

As more than 90% of goods are at some point transported by ships, there is no doubt that the environmental footprint of maritime logistics also requires our attention. It is essential that the increased digitalization efforts not only contribute to the greater efficiency and robustness of the shipping sector but also provide solutions for managing sustainability issues such as ocean pollution, increasing GHG emissions, biodiversity loss, and resources depletion. Besides alternative fuels and sustainable energy storage, digital solutions will be key to meet the International Maritime Organization’s (IMO) commitment to reduce the total annual GHG emissions from international shipping by at least 50% by 2050, compared to 2008.

Maritime transport is responsible for about 2.5% of global GHG emissions; however, a lack of mitigation action can lead to a significant increase.

An interesting example of such a company that is successfully combining digitalization with sustainability is a French start-up Sinay, which provides a vertical SaaS for managing data related to operations and environmental impacts for the maritime sector. It sets an example of how efficient operations can go hand-in-hand with the GHG emissions reduction potential and increased sustainable use of maritime resources. As a such, it is aligned with our focus on partnering up with start-ups that have the potential to transform value chains as well as drive change towards decarbonization and climate protection. Which other start-ups do you know that fulfill these requirements?

Let us know what you think about the future of the digitalization of maritime logistics and how it can help to achieve greater sustainability impact in the sector.

MVP joins forces with the Cleantech for Europe initiative

Europe has seen tremendous growth in VC investment over the past years. According to the State of European Tech 2019 report, capital invested in Europe had more than doubled in five years to EUR 32 billion. Although this is magnificent news, it unfortunately did not help the Continent overcome one of its biggest handicaps, namely its inability of scaling up startups. While for instance, in 2019, the US counted 1,131 deals with a value > USD 25 million, in the EU only 271 deals reached that size; and as the deal size grows, the gap between US and Europe increases both in deal count as well as in deal value.

Especially for technology startups, the process of raising funds to develop to a commercial-scale company with stable revenues, and thus to overcome the so-called valley of death, poses a number of prevalent challenges. As a consequence, many European startups started turning towards Asia or North America for larger markets, more abundant funding, and ambitious public policies that accelerate their adoption.

Unarguably, deep-tech’s need for higher levels of investment over a longer period has made foreign funding inevitable. Still, the above mentioned valley of death becomes particularly dangerous when it comes to technologies relevant for achieving Europe’s Green Deal targets and, thus, Europe’s climate leadership.

In order to build much-needed bridges with policymakers in Brussels and other European capitals, Cleantech for Europe, a new initiative created by Cleantech Group and supported by Breakthrough Energy, was brought to life. In a first instance, six leading cleantech venture capital firms, regarded as pioneers in financing innovative low-carbon companies, are joining the initiative. Startups, scaleups, academia, as well as civil society will join the initiative over time to build a future-oriented, technology-savvy group of cleantech leaders from across the EU.

We are excited to announce that Munich Venture Partners is joining forces with the Cleantech for Europe initiative to fight for a greener and fairer economy together with Beamline Accelerator, btov Industrial Tech Fund, Inven Capital, Rockstart, and SET Ventures. Combined, we have invested in more than 150 innovative low-carbon startups and scaleups so far, including global leaders such as Sonnen or Sunfire. Our aim is to build a collective voice and convey to policymakers as well as other stakeholders the importance of investing in the next generation of clean technologies.

Specifically, the Cleantech for Europe initiative calls on the EU to:

- Create a demand shock for green solutions. Create sectoral transition plans. Implement a predictable and progressive price on carbon. Accelerate green public procurement.

- Support the creation of at least 10 EU scale-up funds. Increase non-dilutive funding. Leverage public-private instruments such as carbon contracts for difference.

- Support cross-border scaling. Harmonize regulations and standards to allow innovative companies scale from one country to the continent. Develop integrated value chains across all member states.

Based on our long experience in the cleantech sector, we trust to be able to support the Cleantech for Europe initiative with our technical expertise, sector knowledge, as well as our learnings in scaling up cleantech businesses.

We hereby would like to thank the Cleantech Group and Breakthrough Energy for setting up the initiative. We look forward to working together and to welcoming interesting partners to our initiative. We are confident that if we succeed at scaling up cleantech, the EU will lead the race to net zero.

About Cleantech for Europe

Cleantech for Europe is an initiative created by Cleantech Group, supported by Breakthrough Energy and leading EU cleantech investors. Our mission is to help the EU lead the race to net zero while creating long-term industrial competitiveness. We aim to put innovation at the center of the public policy debate and build bridges between the EU’s cleantech community and policymakers in Brussels and member states.

MVP Sustainability Report 2021

In addition to generating superior financial returns for our investors, MVP’s investment strategy also focuses on investments generating positive environmental and societal impact. We therefore put great effort in our portfolio companies not only leaving the lowest environmental footprint possible as well as applying the highest social standards, but enhancing nature and society as a whole.

To illustrate the ESG-development of our investees as well as our own sustainability efforts, MVP publishes a yearly sustainability report. Next to these topics, this year’s report also covers:

> Our approach towards sustainability

> Reaching CO2-neutral fund operations

> How our investees contribute to the SDGs

> How we use the Triple Top Line for holistic value creation.

The start-ups driving Circular Fashion in Europe

Paris-based sustainable fashion company Vestiaire Collective just announced to have reached unicorn status in its new €178 million round, making it the latest European start-up to join the exclusive club. The second-hand fashion marketplace has experienced rapid growth over the last three years and has already made its way into the United States and Asia Pacific markets. The growth was certainly accelerated to some degree by the pandemic which favored digital solutions. But more importantly, Vesitaire Collective was early to capture on the material and deep-rooted shift in consumer interest towards sustainability. And this is not limited to buying and selling pre-owned clothing: especially younger consumers are increasingly aware of the environmental and social impacts of the fashion industry, demanding among others more sustainable and longer lasting products and better end-of-life solutions.

Indeed, we can’t neglect that the fashion industry has a broader sustainability issue: already before the pandemic, the equivalent of one garbage truck of textiles was landfilled or burned globally every second. This has likely increased further over the past months as shops are closed and unsold clothing piles up in fashion and textile warehouses. Furthermore, less than 1% of products are recycled into new garments and despite efforts by some players 12% of fiber is lost in production (Source). Not to forget that in some production facilities, garment workers toil 16 hours per day earning a fifth of the minimum wage required for a decent life.

10% of global carbon emissions are calculated to stem from fashion today. This could increase to up to 25% in 2050.

On a positive note, there are already several companies who strive to move the fashion industry away from the take-make-waste thinking towards circular strategies which respect all three pillars of the Triple Top Line: economic growth, environmental impact, and social equality. (Read more about the Triple Top Line idea here). Accenture estimates that circularity holds an economic value potential of $30-90 billion for the fashion industry. Indeed, it could become the biggest disruptor to the industry over the next decade.

At MVP, our focus is on partnering up with start-ups that have the potential to transform value chains and drive change in the most CO2 intensive and pollutive industries. And we see that alongside Vesitaire Collective, an entire ecosystem of start-ups has emerged in Europe that have this potential. They are developing bio-degradable raw materials, bringing transparency to the supply chain, enhancing the lifetime of clothes with rental or second-hand platforms, or recapturing raw materials from non-reusable products.

To provide an insight on our view of the industry, we want to share this (non-exhaustive) map of European Circular Fashion start-ups. It includes companies in very early development stages as well as more established players that have already raised significant amounts of funding. We want it to be a source of inspiration, collaboration, and a starting point for discussions.

Let us know what you think about the landscape and who is missing.

Circular Fashion Landscape

SupplyCompass, Upmade, Material Exchange, circular.fashion, MycoTEX, Spintex, Pili, ananas anam, Spinnova, Amadou Leather, Jeanologia, Fairly Made, rodinia, Colorifix, We aRe SpinDye, Lukso, retraced, TrusTrace, Tailorlux, Compare Ethics, Sircula, Reflaunt, Stuffstr, DressYouCan, Fjong, Hackyourcloset, By Rotation, gibbon, Hurr, Videdressing, vinted, momox, Swapush, Popswap, Sellpy, Mädchenflohmarkt, Rebelle, nuw, Vestiare Collective, Repamera, Thrift+, Zadaa, Kleiderly, REKKI, armadioverde, cudoni, Worn Again, Renewcell, Infinited Fiber, Eoe Regrind, and Sea2see.

________________________________________

Julian is Investment Associate at Munich Venture Partners. While he is not a fashion specialist nor known for an outstanding dressing style, he has great interest in the field of Circular Economy and sustainable consumption in general. With this lens, he looks at different industries and sectors. Feel free to contact him via LinkedIn.

sonnen: Transforming the energy sector along the Triple Top Line

sonnen is one of the world’s leading manufacturers of battery systems for the storage of photovoltaic electricity for private households. Back in 2014, MVP was among the first investors of the company based in Wildpoldsried, Germany. In 2019, sonnen was acquired by Shell, which together with sonnen aims to become the world’s leading energy service provider by 2030. For the cleantech sector in Europe, the takeover was one of the most successful venture capital exits ever.

Key factors for sonnen’s success were the ongoing willingness to transform its product, business model, and team, as well as a business strategy based on the Triple Top Line concept. This ultimately led to significant changes in the energy market. And it makes sonnen a Transformative Technology in the best sense of the word and a perfect example to illustrate our investment strategy.

Transformation of product and business model

The first sonnenBatteries offered customers the opportunity to store self-produced PV electricity and to use it in times without sufficient sunlight. The company’s growth in the early years was proof that the sonnenBatterie was one of the best products on the market (Improvement of the Value Chain).

From the very beginning, however, the sonnen team understood the sonnenBatterie as the platform on which further products and services could be offered. The possibility of connecting all sonnenBatteries via the Internet of Things (IoT) enabled sonnenBatterie customers to share self-produced and stored electricity, which was the starting point for the sonnenCommunity. By that, today’s centrally structured value chain from electricity production in large power plants to the consumption at the end customer is eliminated by decentralized production and storage (Enhancement of the Value Chain).

With the next expansion stage of the sonnen business model, sonnenNow, customers will be offered a complete package consisting of a photovoltaic system, a sonnenBatterie and clean electricity, without any investment costs for the customer. This means that sonnen offers a Power-as-a-Service solution instead of a hardware product. A revolutionary step, which is only known from the software sector so far, or in the first tentative steps in the mobility sector. sonnen thus transforms the entire value chain of power supply (Reconstruction of the Value Chain) and becomes the energy utility of the future.

Transformation of the team

sonnen has continuously strengthened its team and adapted it to the requirements of the company’s development from its foundation to the present day. In the first years the focus was on product development and sales. In the following years, the supply chain and production team also had to be expanded. With the introduction of the sonnen Community, the interconnection of sonnenBatteries, the establishment of an own software team was necessary. And for the last step, the establishment of sonnen as the energy utility of the future, a team of experts with many years of experience in the energy markets was set up. With the growth from the small founding team around Christoph Ostermann and Torsten Stiefenhofer to a medium-sized company with several hundred employees, the organization, including finance, HR, marketing, had to be continuously expanded.

To successfully manage this substantial transformation of the team organization in just a few years is one of the essential success factors for the rapid scaling of start-ups – sonnen has mastered this excellently.

Focus on Triple Top Line growth

sonnen’s slogan “clean and affordable energy for everybody” illustratively reflects that the company follows a business strategy, which considers not only economic growth but also social equity and sustainable environmentally friendly product development. From the very beginning, sonnen’s primary goal has been to make more renewable energy available to private customers, and thus make a contribution to an ecologically sustainable energy supply (Ecology). The new approach of making the sonnen solution accessible to customers without investment costs ensures social Equity. Combining these two aspects with a highly scalable business model, sonnen was also able to achieve extraordinary economic growth (Economy).

With this consistent pursuit of the Triple Top Line concept, sonnen shows that growth and economic success do not require compromises with regard to environmental benefit and social equity, but that all three aspects reinforce each other positively. It was decisive for the outstanding development of sonnen and ultimately for the takeover by Shell. (Read more about our Triple Top Line investment strategy)

MVP Sustainability Report 2020

The MVP Sustainability Report 2020 is now online. As a signatory of the UN Principles for Responsible Investment, we put a great effort in our portfolio companies not only leaving the lowest environmental footprint and applying the highest social standards but enhancing nature and society as a whole.

You should definitely not miss out this year’s booklet if you are eager to learn more about:

- Our approach towards sustainability

- The ESG (Environmental, Social, and Governance) performance of the MVP portfolio, including the nomination of our first ESG Champion

- Why we decided to go a step beyond the standard ESG approach

- How we are currently implementing the Triple Top Line approach into the Venture Capital world

Grab a coffee and have a good time reading!

Introducing the Triple Top Line

The integration of ESG (Environmental, Social, and Governance) factors into investment processes and decision making has seen tremendous growth in recent years. Additionally, with the investment world adopting an active role in achieving the UN Sustainable Development Goals (SDGs), we see a rising need for a framework enabling sustainable and quantifiable value creation as well as a straightforward implementation. We believe to have found the solution in the Triple Top Line. But first, let’s see why the Triple Top Line excellently meets today’s Zeitgeist and how it takes our sustainability practices to the next level.

> The rise of ESG < Investors trimming their portfolios for sustainability, food manufacturers praising the CO2 neutrality of their production, or companies marketing their coal phase-out planned for the next two decades, are all to be understood as reactions to changing customer needs and – ultimately – as a fight for legitimacy and survival. The race for sustainability just entered a new dimension.

There is no doubt that industrialization has contributed to social welfare by supplying high-quality products adapted to human necessities as well as by ensuring the right working conditions for employees. But our globalized system also made it easier for some companies to plunder natural resources, exploit cheap labor, and exacerbate the inequality of wealth by earning profits from their operations in less developed countries and distributing them to their shareholders in wealthier ones. But these times are coming to an end. With our society facing extreme challenges such as climate change, infectious diseases, and resource scarcity, our economies will have to undergo a profound structural change and companies will have to take action.

And many of them already did. 2019 could certainly be called „The Year of ESG” (Environmental, Social, and Governance), with daily announcements from companies having implemented ESG criteria, having reached 30+ of ESG key performance indicators (KPIs), or having achieved 100% ESG conformity. This comes slightly delayed, but is a step in the right direction and is actually based on scienetific results. A study conducted by Harvard Business School’s Serafeim showed that companies having developed organizational processes to measure their ESG performance in the early 1990s outperformed a carefully matched control group over the next 18 years. Similar results are provided by Nordea Equity Research as well. And let’s not forget customers for whom ESG compliance is not an option anymore – but a duty.

As a signatory of the UN Principles for Responsible Investment (UNPRI), Munich Venture Partners (MVP) has a longstanding history in measuring the impact of its portfolio through company specific ESG KPIs. Besides learning a lot about our investees’ operations, our ESG experience also taught us why ESG is a perfect tool for negative screening and early risk identification but incomplete when it comes to outlining the whole impact of our portfolio. Particularly by mainly focusing on the past (12 months’) performance, ESG neglects the huge potential of early-stage companies, which just might need some additional years to be able to shine with huge numbers. Moreover, by separately tracking environmental, social, and governance factors, ESG neglects the interaction between these pillars and misses out the impact of each on the other.

> Taking one step at a time < Unlike ESG – which by establishing policies and processes guarantees a minimum level of sustainability, the UN Sustainable Development Goals (SDGs) are more output oriented and illustrate how investment decisions impact the broader environment and society as a whole. As we believe this better reflects the fast-paced and future-oriented Venture Capital sector, we decided already in 2018 to go beyond the standard ESG approach and linked the E/S/G KPIs we have been tracking to the SDGs. We are thereby guiding our investees towards long-term orientation and focusing on the road that lies ahead.

However, we see a rising need for an assessment framework which can deal with individual requirements, may it be startups, venture capitalists, or fund investors, the complex structure of the SDGs, and – above all – their holistic nature, meaning that all goals must be achieved in unison. To put it another way – if we want to achieve the SDGs by 2030, we need to get structure in our impact assessment. But how?

> Adapting the past < Developed 25 years ago, the Triple Bottom Line seemed to be the answer to increasing pressure on organizations to deliver performance that is socially equitable, environmentally responsible, and economically sound. These Triple Bottom Line domains of People, Planet, and Profit have defined long-term strategies of global corporations and have shaped the view that to be truly sustainable, a balance must be struck between all three. However, by purely focusing on the management of negative effects, the approach has also been criticized for missing out many opportunities of innovation and value creation.

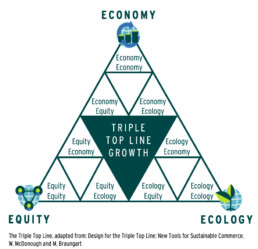

> Introducing the Triple Top Line < Whereas the Triple Bottom Line mantains an aging system by reducing its negative impacts, the Triple Top Line concept developed by W. McDonough and M. Braungart builds the foundation of a new one, which rather than balancing economic, ecological, and social equity targets, chooses to employ their dynamic interplay to concurrently generate value on all pillars.

The Triple Top Line is embodied in a fractal triangle. When using this tool, the starting point is the top corner[i] of Economy – Economy as the first aspect to be considered is whether a product can be offered at a profit or not. If that is not the case, the process ends here due to lacking economic viability. Otherwise, one can start moving around the fractals and examine how progress can be generated in each. In W. McDonough and M. Braungart’s model this is attained through questions as: Will our production process use resources efficiently? Are we finding new ways to honor everyone involved, regardless of race, sex, nationality, or religion?

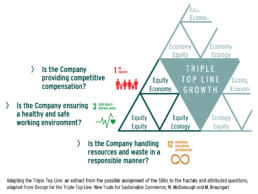

> Using the Triple Top Line < Our first step in implementing the Triple Top Line into the Venture Capital world meant translating the SDGs into investible opportunities and linking them to the fractals of the Triple Top Line. Inspired by the original model, we then elaborated our own set of questions for each fractal. We thereby took into account the value creation opportunity in the respective fractal as well as the sub-targets of the assigned SDG(s).

By condensing it down to 9 simple questions – one for each fractal – and deriving tangible measures and KPIs out of these, we found a straightforward way of implementing the Triple Top Line on a portfolio company level.

We use the Triple Top Line both pre-investment, to evaluate startups as part of our Due Diligence processes, as well as during the active holding period, as a very effective controlling and guidance tool. On a yearly basis we evaluate the progress achieved by our investees in each fractal, analyze where there is still room for improvement, and set new targets. Additionally, an underlying scoring system enables us to track and compare the progress of our portfolio companies.

Through this mechanism we adhere to one of the guiding principles of the Triple Top Line: Be efficient and effective. Effectiveness means doing the right things – which for us translates into contributing to the SDGs – while efficiency means doing things the right way – which we ensure through our KPIs.

> What we particularly like about the Triple Top Line < The Triple Top Line aims for a sustainable industrial system, generating economic returns while enhancing nature and society. By concurrently maximizing value on all three pillars, the Triple Top Line points out that economic growth, environmental gains, and societal value creation are not only interconnected but mutually reinforcing each other. By using the Triple Top Line, we can assure that our investments are contributing to the SDGs in a holistic manner and with quantifiable results. For us and our fund investors this translates into over-proportional financial returns accompanied by value creation on two additional pillars.

By narrowing it down to 9 simple questions and derived targets, we enable our portfolio companies to focus on high-leverage measures without losing sight of the big picture. Additionally, rather than using their resources to report on umpteen KPIs, our portfolio companies can focus on identifiying the measures with the highest impact. For us, the adapted Triple Top Line is a tool which enhances continuous progress through small – but very effective – steps and through clear targets.

> The window for action is open < The SDGs represent an urgent call for action. If we want to limit global warming within the acceptable range of 1-2°C compared to pre-industrial levels, meet the challenges of a growing population – and so many more – the main actions need to be triggered today.

Successful entrepreneurs have recognized that the most important ingredient for their secret sauce is a good relationship with society and the environment. These mission-driven leaders are just about to disrupt existing industries by leveraging technology and breakthrough innovations. Reduced emissions from a renewable-based energy sector, the rising uptake of shared mobility, and a more efficient manufacturing sector will lead to an increasingly decarbonized world, while IoT solutions within the food sector will reduce food waste and help us sustainably feed a growing population.

Many solutions are already out there, let’s put them into practice together.

[i] In the original model Economy is the bottom right corner

What's "driving the eco-industrial revolution" about?

Climate change has entered a new phase. Alarming signals of an ever more rapid change in the biosphere are increasing. And scientists highlight that earth may have already passed several climate change tipping points which has irreversible effects, such as the loss of the Amazon rainforest and the great ice sheets of Antarctica and Greenland. At the same time, it is becoming a decisive political factor with hundreds of thousands of young people pioneering a new extra-parliamentary climate opposition.

…it’s about decoupling economic growth from environmental pollution

As the world’s population is rising to over 9 billion people in 2050, countries of the South and the East are becoming increasingly industrialized, and cities continue to grow, global economic output will roughly double in the next 30 years. Over the same period, greenhouse gas (GHG) emissions will have to fall dramatically in order to reach the GHG reduction targets set by governments. For the EU, the binding target is a cut by at least 40% compared to 1990 levels by 2030. This puts a great burden on the economy. However, the question is not whether the global economy will continue to grow. The key question is whether we can decouple value creation from environmental pollution.

The recipe is nothing less than a new industrial revolution with an impact similar to the invention of the steam engine, industrial steal making, or the automobile: the eco-industrial revolution.

In essence, it is about a threefold transformation of the old industrial society: firstly, a complete shift from fossil energy sources to renewable energies; secondly, a continuous increase in resource efficiency to generate more value from fewer raw materials and energy; and thirdly, the transition to a circular economy in which the productivity of resources is increased.

…it’s about fostering the transformative power of technology

Similar as the first industrial revolution was triggered by the invention of the stream engine, also the eco-industrial revolution will be driven by technological innovations and their expansion. However, this time, we require technologies that allow a rethinking of existing value chains to reduce CO2 emissions along the entire process of value creation.

At MVP, we call such technologies that (I) improve, (II) enhance, or (III) reconstruct existing value chains Transformative Technologies. They trigger fundamental changes and paradigm shifts in existing business areas in short time frames. To some degree, Transformative Technologies can also be viewed as disruptive. However, rather than the disruptive “destroy and build new” approach, Transformative Technologies may also enable developing new enhanced solutions using existing infrastructure whenever possible. They are the basis for shaping the future and have an extraordinary growth potential. Identifying these opportunities and financing appropriate technologies and solutions is one of the strategic cornerstones of MVP’s Venture Capital investment approach.

…it’s about leveraging total value potential

Our focus is on driving change in the most CO2 intensive sectors and financing businesses that can have a huge impact in achieving decarbonization of the incumbent industry. To make it clear: it’s not about limiting economic growth in favor of ecological sustainability. We are firmly convinced that economic growth and ecological sustainability are not tradeoffs, but in contrast mutually reinforcing factors. With investments in companies like sonnen we were able to verify this thesis in the past. Even more, companies and business models, which do not take into account ecological responsibility, will not be successful anymore or disappear completely.

Therefore, we integrate the concept of Triple Top Line value creation in our investment strategy to leverage the full transformative potential of a technology. Rather than balancing economical, ecological and societal targets, this approach focuses on employing their dynamic interplay to generate value. (Read more about our Triple Top Line strategy here)

Driving the industrial revolution is the core philosophy of our investment approach. In fact, that’s what we’ve been doing at MVP for over 15 years now. With this experience and the capital entrusted to us, we back pioneering entrepreneurs and become sparring partners for ambitious teams to create the business leaders of tomorrow.

Are startups in a position to transform markets?

How do markets develop, when can a start-up participate in them – and how does it get there? WirtschaftsWoche kicks off a new column on investor insights with an interview with MVP Partners Martin Kröner and Walter Grassl (German only).

Click here to read the full interview